direct deposit owner's draw quickbooks

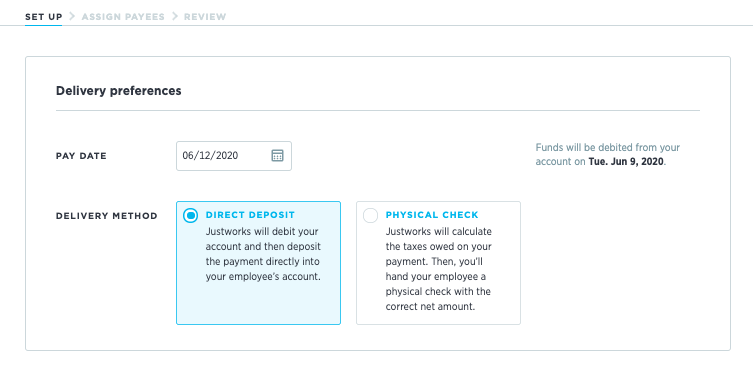

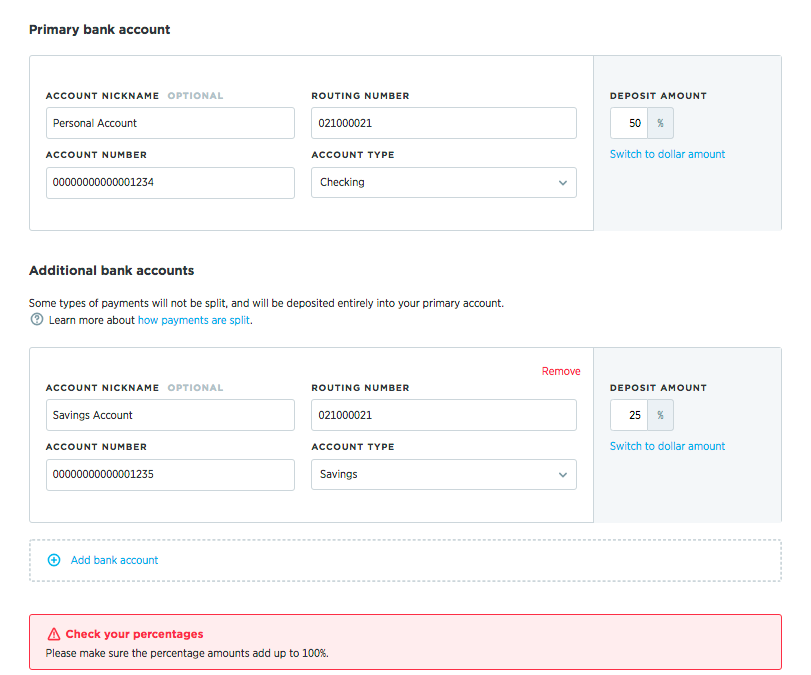

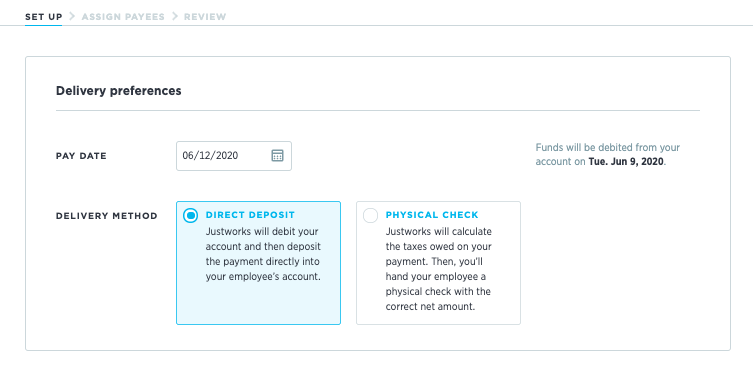

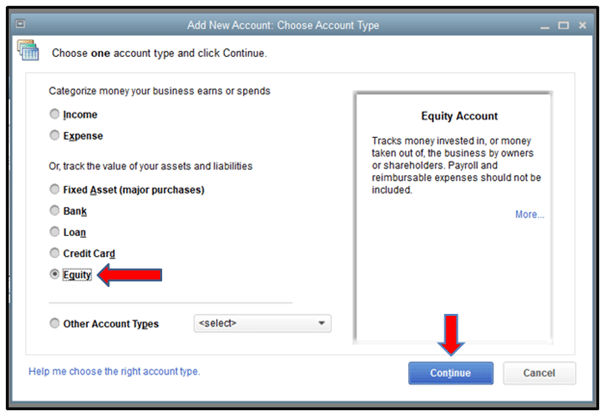

Click Equity Continue. Select Use Direct Deposit for checkbox and then select whether to deposit the paycheck into one or two accounts.

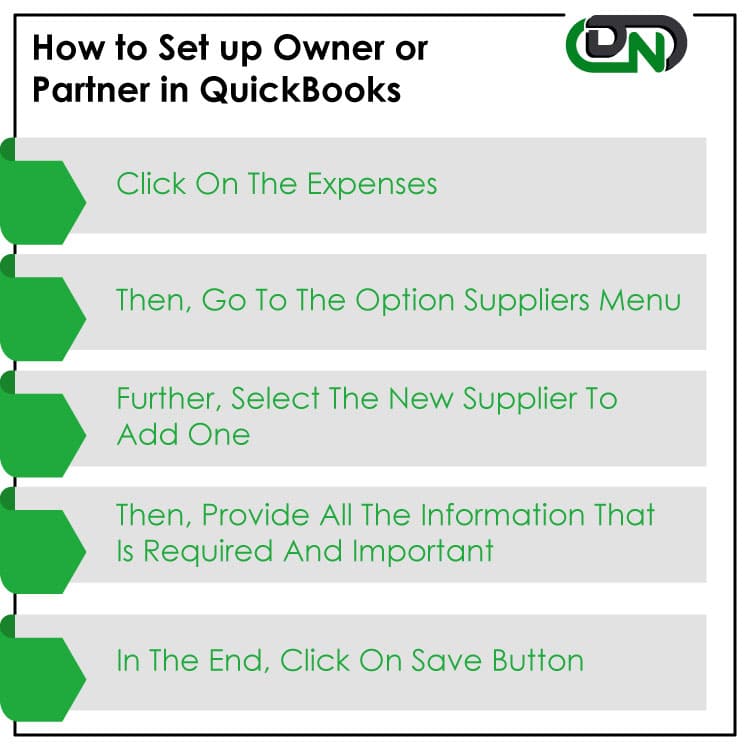

How To Record Owner Investment In Quickbooks Set Up Equity Account

Step 2 The form starts out by asking the employee to provide the information pertaining to the principal account into which the funds will be deposited.

. Easily Pay your Employees. The Intuit Quickbooks payroll direct deposit form is a legal document that allows an employer to provide payments to its employees via direct deposit. I called quickbooks just to get an automated response that they were experiencing issues with direct deposit payroll services and working hard to fix the issue.

You must establish them yourself. Create the paychecks in QuickBooks. In this scenario youre the only owner so you have total control over when you take a draw.

Complete and review the structure. To write a check from an owners. Make sure you have selected the Equity account.

Enter in the following. This article describes how to Setup and Pay Owners Draw in QuickBooks Online Desktop. Guarantee the Zip code has only 5 digits.

I was in line for a chat and they cut it off and then disabled the chat function. Navigate to the List option in the upper left of the windows menu bar. In the Verify Your Company Information zone.

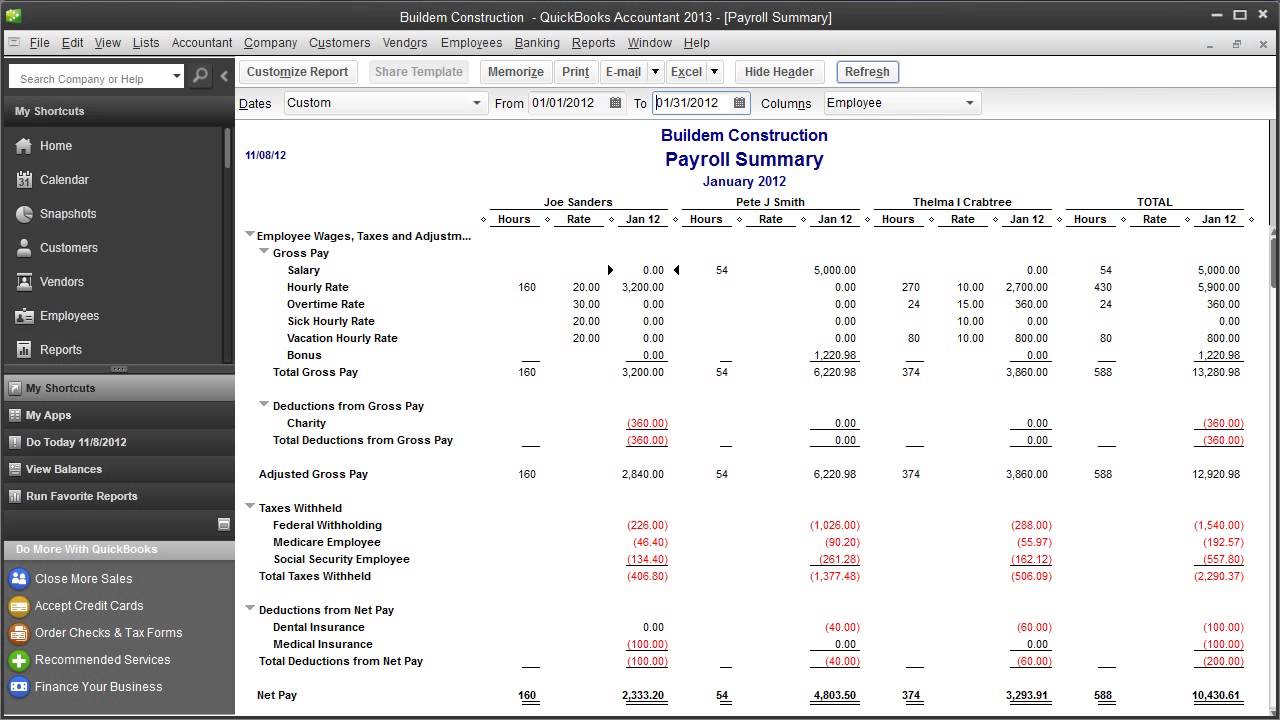

An owners draw account is a type of equity account in which QuickBooks Desktop tracks withdrawals of assets from the company to pay an owner. Enter the employees financial institution information and then click OK to save the information. This document must be signed by employees requesting automatic deposit of paychecks and retained on file by the employer.

To set up your company for direct deposit in QuickBooks verify your companys information including the legal name address EIN and industry. How do I put personal money into my business account. Signing up and validating your bank account.

The accrual basis of accounting. Do whatever it takes not to consolidate the growth. Quickbooks is confusing its users on this topic.

You have an owner you want to pay in QuickBooks Desktop. For the law firms and lawyers quickbooks will track time and each expense for each case as needed. An owners draw is when an owner takes money out of the business.

Or you can use the convenient Direct Deposit feature additional fees and setup required. To record an owner contribution in Quickbooks launch the Quickbooks program and click the Banking tab at the top of the home screen. If youre a sole proprietor.

This way you will never miss any transaction done for or in favor of business growth. In this video Ill show you how to enter the owners draw in QuickBooks Online. Print Pay Cheques Once youve reviewed your pay cheques you can print them from your computer.

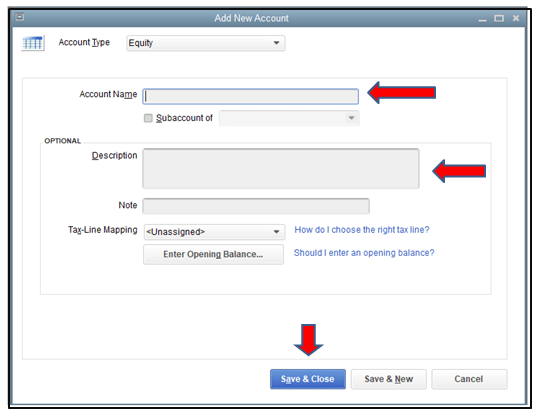

I started getting texts from employees at 820am saying they havent been paid. Enter the account name Owners Draw is recommended and description. At the bottom left choose Account New.

You can add items to the Chart of Accounts by clicking the Add link. From here choose Make Deposits and then select the bank account where youd like to deposit your personal investment. QuickBooks copies the payment terms used in the last company you set up.

Click Set Up Direct Depositin the Other Activities area on the Pay Employees tab and follow the on-screen instructions to sign up for direct deposit service give us your bank account information and create a direct deposit PIN also called a payroll servic e PIN. How Do You Record OwnerS Draw In Qb. Click Chart of Accounts and click Add.

When you attempt to make a direct deposit payment to an owner it specifically says something like in order to comply with the law direct deposit payments can only be made to independent contractors. You can either set up your direct deposit while setting up payroll or by going to EmployeePayroll InfoDirect Deposit. You will need to decide which Account or Accounts you wish your payment to be deposited to then report the information defining the target Account s.

You can do direct deposit to your employees with the help of quickbooks. Please enter Owner Drawings as your accounts name and click OK. Intuit Quickbooks Direct Deposit Authorization Form.

QuickBooks creates no payment terms. Start paying employees using Direct Deposit. Details To create an owners draw account.

Enter Owner Draws as the account name and click OK. Open the chart of accounts and choose Add Add a new Equity account and title it Owners Draws If there is more than one owner make separate draw accounts for each owner and name them by owner eg. Update any owner information if needed.

Choose Lists Chart of Accounts or press CTRL A on your keyboard. QuickBooks Payroll calculates earnings payroll taxes and deductions. See telpayca for more details.

Also you will need to Name and Authorize your employer to. If youre curious about the notion of tracking the withdrawal of company assets to pay an owner in QuickBooks Online keep. Typically this would be a sole proprietorship or LLC where the business and the owner are considered the same for tax purposes.

It is another separate equity account used to pay the owner in QuickBooks. An owners draw account is an equity account in which QuickBooks Desktop tracks withdrawals of the companys assets to pay an owner. Once again the answer depends on how your business is set up.

Step 1 The form should be downloaded in Adobe PDF and opened up on your computer. Steps to Recording an Owner Contribution in Quickbooks. Do not send this form to Intuit.

QuickBooks creates a list automatically for customers only. Select the Equity account option. This has always been ok up until now.

Account 1 Account 1 type. Direct Deposit in the Employee Information section. Register For Direct Deposit Go to the Employees menu select My Payroll Services by then Activate Direct Deposit.

From the quickbooks. Employees must attach a voided check for each of their accounts to help verify their account numbers and bank routing numbers. Investing Money in Your Business If your business is not a corporation you can put money into your business by just writing a check and depositing it in the business bank account.

Click Save Close. Any money you pay yourself is actually an owners draw. QuickBooks creates a list automatically which can then be modified.

And your employees will get their payment within 24 hours. Time Tracking and Bill Expenses. All the withdrawals will be recorded in this account which is done by the owners.

Set up draw accounts. With the help of an owners draw account you are enabled to record any kind of withdrawals from the bank account. How to Record Owner Draws Into QuickBooks Click the List option on the menu bar at the top of the window.

An owners draw may sound tempting to use but its vital to know exactly when you can.

How Can I Pay Owner Distributions Electronically

![]()

Sba Ppp Eidl Tracking In Quickbooks Susan Gunn Solutions

Setup And Pay Owner S Draw In Quickbooks Online Desktop

Intuit Quickbooks Payroll Increase Direct Deposit Limits Youtube

Owner S Draw Quickbooks Tutorial

How To Record Owner Investment In Quickbooks Set Up Equity Account

Fascinating Collective Bargaining Agreement Sample Contract In 2022 Contract Template Rental Agreement Templates Spreadsheet Template

Splitting Your Payments Into Multiple Bank Accounts Justworks Help Center

Quickbooks Tip Clean Up And Fix Undeposited Funds Long For Success Llc

How To Record Owner Payments Owner Deposits In Quickbooks Part 6 Video 3 Small Biz Bookkeeping Youtube

Solved Owner Has Been Incorrectly Taking Owners Draw Inst

How To Run Payroll Set Up Direct Deposit In Quickbooks Online Youtube

How Can I Pay Owner Distributions Electronically

Off Cycle Payments Justworks Help Center

How Do I Pay Myself Owner Draw Using Direct Deposi

How To Record Owner Investment In Quickbooks Set Up Equity Account

How Do I Pay Myself Owner Draw Using Direct Deposi

Loaner Car Agreement Template Free Printable Rental Agreement Templates Contract Template Agreement

Question Can I Pay A Draw Through Quickbooks Payroll Seniorcare2share